For the longest time, we have enjoyed the free services of GCash. It is a safe and secure mobile wallet app that’s very convenient to use. But they have announced that they are going to charge a 2.58% GCash Cash-in Fee for their Visa and Mastercard bank card service. Is it really a move made by GCash to gain profit from every transaction? Read on to learn more.

The 2.58% GCash Cash-in Fee

Are you an avid user of GCash? Wifey and I are. We use it to pay for some online purchase, our credit card bills, funding some accounts, as well as loading our Globe accounts.

It’s so fast, safe, and convenient to use. We can do our banking even at midnight, when all is quiet and peaceful in the household. Then we can concentrate on adulting stuff–like paying bills.

However, GCash recently announced a that they are going to charge a convenience fee for cashing in using linked Visa/MasterCard bank cards. This will take effect on July 6, 2020 and will amount to 2.58% of the total amount to be cashed in for each and every transaction.

Now, it seemed like GCash just let us get used to their free services so that one day they can charge us, right? But actually, the fee is a direct charge of GCash’s card payment partners and NOT GCash itself. That means, all the fees collected will go directly to the card payment partners of GCash. GCash will not earn from the 2.58% convenience fee that are passed on to users.

Furthermore, GCash would not have to pass any convenience fee for their cash-in via Visa/MasterCard bank card service if not for the charges implemented by the payment partners.

You Can Still Cash-in for FREE

But there’s a bit of a good news here.

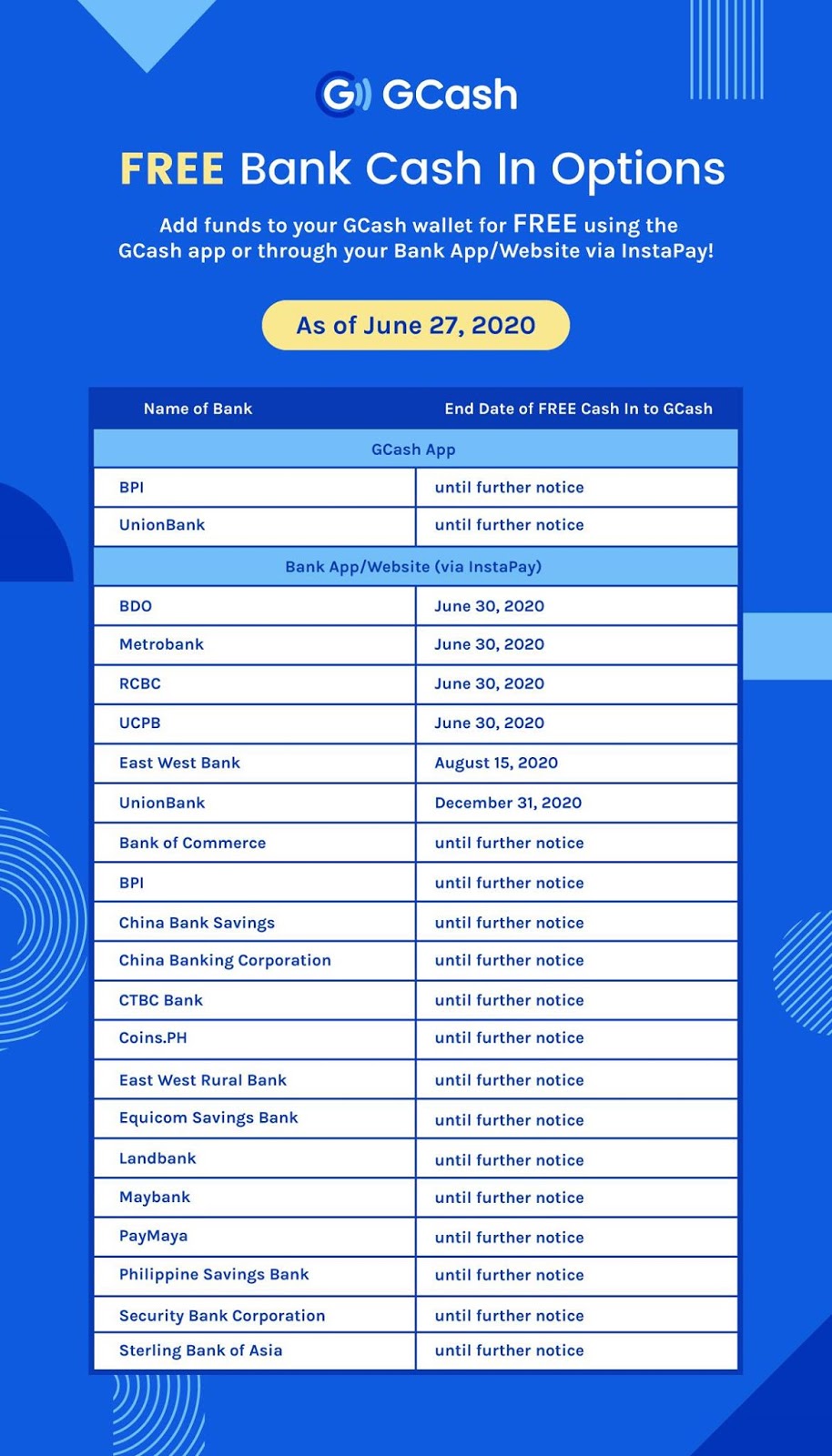

GCash still provides other cash-in methods that are totally FREE to use. You can cash-in via your linked BPI or UnionBank accounts–banks that are usually utilized by online workers. Additionally, you may go through a bank app or website powered by InstaPay. It just might mean though that you may have to switch banks.

This is the list of linked banks with GCash and their schedule of implementation of cash-in fees. You will also see which banks will continue to give free service.

Honestly, this really made us sad because aside from BPI and Unionbank, wifey and I are avid users of the BDO to GCash feature. We might soon have to change this in order to avoid getting charged.

Benefits of Linking Your Bank Account to GCash

When you link your bank account to your GCash, you can directly top-up your GCash anytime and anywhere. Bank account linking is directly linking your bank account to GCash. These are first-party networks that are directly between the partner bank and GCash.

You can use this virtual cash to pay bills, send money to loved ones, or make online purchases. Moreover, you can use your GCash for your supermarket or mall purchases when you can go out.

Meanwhile, do not worry so much about the 2.58% GCash Cash-in Fee imposed by some banks. You can still cash-in for free if your bank is supported by Instapay.

Why GCash is Still the Best

I can say that GCash is still the best mobile wallet app there is because we are avid users. There are just so many things I can use it for.

There are more than 70,000 partner merchants nationwide that accept GCash payments. And these include supermarkets and restaurants. I can also conveniently pay my bills through the GCash Pay Bills and transfer money through the GCash Bank Transfers.

GCash is also equipped with value-added services such as GCredit, GSave, and GInvest, though I still yet have to make use of them.

Additionally, despite the convenience fees passed on by some banks, it is still lower than other mobile wallet services that charge a flat rate of P30. This really matters for those transactions before P1,000.

All in all, GCash is the best there is and we shall continue to use it.

Almost all,had Gcash ,it is more convenient,less hassle,other features and perks are amazing

Now I know. Another informative blogpost. Thanks again for sharing.